Lead

The latest reading from Bitwise’s crypto sentiment index has flashed a contrarian buy signal, indicating deeply bearish positioning across the market. The firm noted the intraday index is as bearish as it was during the October 10 liquidation, with pessimism most acute in Bitcoin options and among short-term holders posting realized losses.

Key Developments

- Contrarian buy signal: Bitwise reported its sentiment gauge moved into a zone historically associated with rebound setups.

- Extreme intraday bearishness: The intraday index reached levels comparable to those seen during the October 10 market washout.

- Where the stress is: The most pronounced negative sentiment appears in BTC options markets and in loss metrics for short-term holders, a cohort often sensitive to rapid price swings.

What the Data Shows

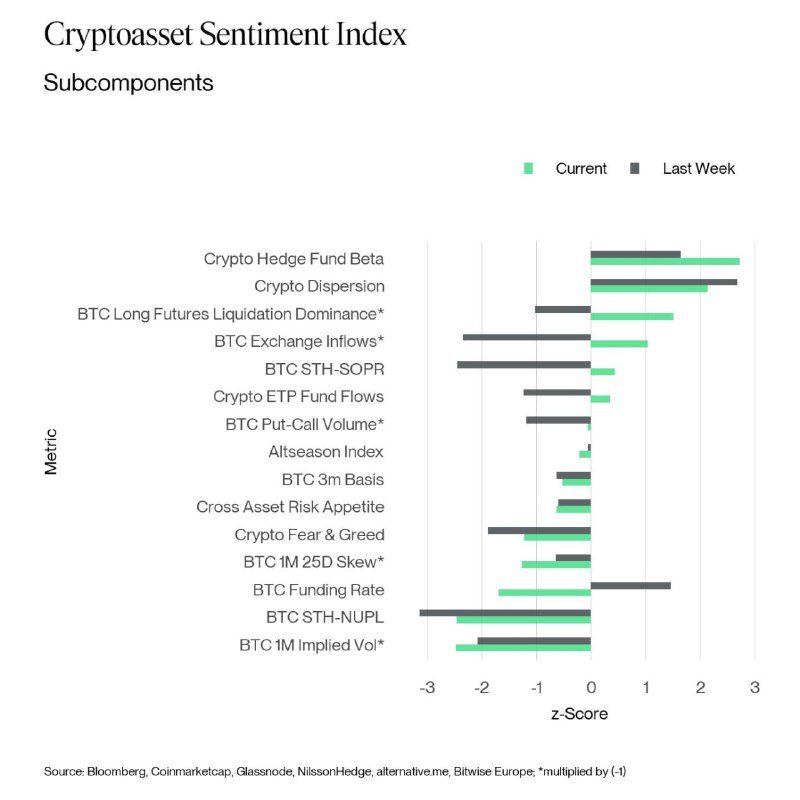

A comparative chart of the index’s component metrics (shown with current vs. previous week z-scores) highlights shifting crosscurrents in market structure:

- Notable improvements week-over-week in Crypto ETF fund flows and the BTC funding rate, both showing positive z-scores relative to last week.

- Broader coverage includes metrics such as Crypto Hedge Fund Beta, BTC dispersion, and exchange inflows, offering a multi-factor view of investor positioning and market risk.

- Data inputs span major market and on-chain sources, including traditional financial data and blockchain analytics providers.

The combination of extremely bearish options sentiment and short-term holder losses—alongside improving ETF flows and funding conditions—suggests a market that is pessimistic in the near term yet not uniformly weak across all indicators.

Market Context

Contrarian buy signals are not forecasts but often indicate oversold conditions and crowded bearish positioning. Historically, extreme negative sentiment has coincided with local bottoms or relief rallies in crypto, though timing and magnitude vary.

- BTC options: Deep bearishness typically shows up through skew, implied volatility dynamics, and protective positioning, reflecting hedging or outright short exposure.

- Short-term holders: Elevated realized losses among recent buyers can signal capitulation; if selling pressure subsides, it can set the stage for mean reversion.

- ETF flows and funding: The improvement in ETF inflows and a firmer funding rate may indicate stabilizing institutional interest and balanced derivatives positioning compared with last week.

What to Watch Next

- The persistence of options market skew and volatility term structure for signs of risk aversion easing.

- Short-term holder profit/loss metrics to gauge whether capitulation is abating.

- Ongoing ETF flow trends and derivatives funding rates for confirmation that institutional and perpetual futures demand is returning.

Conclusion

Bitwise’s latest readout captures a market at a sentiment extreme, with bearish positioning concentrated in BTC options and short-term holder pain, even as ETF flows and funding show incremental improvement. If historical contrarian dynamics hold, conditions may be ripe for a rebound, but confirmation will depend on sustained improvement across derivatives and spot flow metrics.