Lead

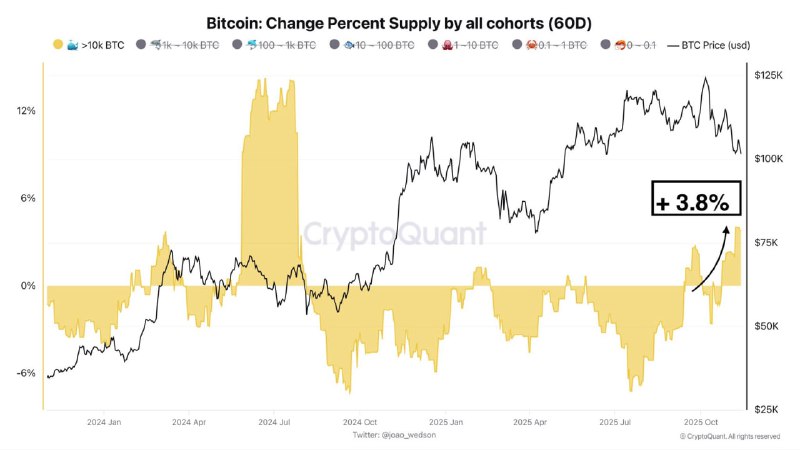

Large Bitcoin holders holding more than 10,000 BTC have shifted from a year-long distribution trend to accumulation. Initial signs of this turnaround appeared in September, with whale reserves rising by 3.8% over the past two months, according to on-chain cohort data.

Key Developments

- Whales with >10,000 BTC had been selling since July 2024, a trend that lasted for more than a year.

- Accumulation signs emerged in September (2025), followed by a 3.8% increase in their reserves over the subsequent two months.

- The shift is visible in cohort-based on-chain metrics tracking changes in supply held over rolling 60-day periods.

On-Chain Signals

Recent cohort analysis shows a positive swing in the 60-day percentage change of Bitcoin supply held by the largest addresses, highlighting a +3.8% uptick. A chart of “Bitcoin: Change Percent Supply by all cohorts (60D)” spanning 2020–2025 illustrates this move alongside the BTC price in USD, underscoring a notable inflection after a prolonged distribution phase.

Market Context and Outlook

Whale accumulation historically correlates with improving market confidence and can precede higher volatility or trend continuation. While some market observers link renewed buying to seasonal dynamics around late November, the data primarily indicates a structural shift in large-holder behavior rather than short-term speculative flows.

Key points to watch:

- Whether whale accumulation persists into December and Q1.

- Any confirmation from exchange flows and realized on-chain profit/loss metrics.

- BTC price reaction around resistance levels if accumulation continues.

Conclusion

After more than a year of distribution, Bitcoin’s largest holders appear to be rebuilding positions, with a 3.8% rise in holdings over two months signaling a potential change in market dynamics. Sustained accumulation by this cohort would strengthen the case for a more constructive medium-term outlook for BTC.