Lead

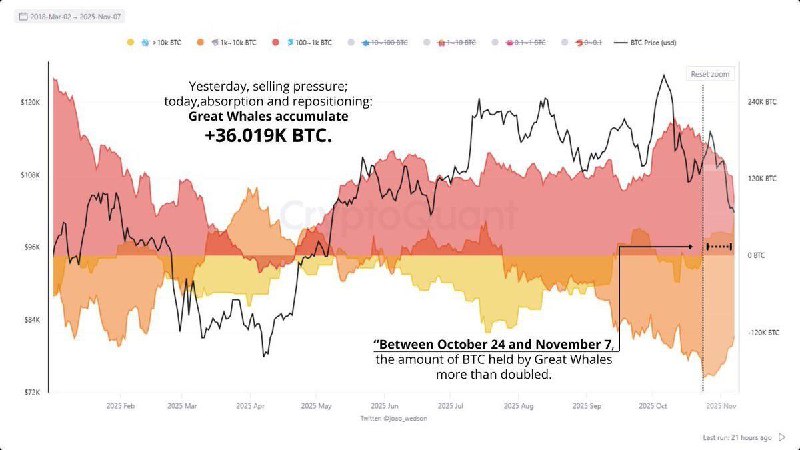

Large Bitcoin holders accelerated accumulation between October 24 and November 7, with addresses holding more than 10,000 BTC more than doubling their combined holdings. During the same period, so-called Great Whales added approximately 36,019 BTC, signaling renewed demand from the market’s largest participants.

Key Developments

- Great Whales accumulate +36,019 BTC over the period

- Holdings more than doubled among addresses with balances exceeding 10,000 BTC

- Activity concentrated between October 24 and November 7

Why It Matters

Whale accumulation often serves as a sentinel for shifting market dynamics:

- Addresses with >10,000 BTC typically represent institutional-scale investors, treasuries, or entities managing significant reserves.

- Rapid increases in whale holdings can reduce available supply on the market, potentially tightening liquidity and influencing price discovery.

- Historical patterns suggest whale behavior can precede periods of heightened volatility, though it does not guarantee directional outcomes.

Market Context

- The accumulation suggests a phase of strategic positioning by deep-pocketed entities over a two-week window.

- Such inflows can reflect growing confidence, hedging strategies, or anticipation of upcoming catalysts.

Large-scale accumulation by Great Whales indicates that major players were actively increasing exposure in late October through early November, a period often associated with elevated market activity.

What to Watch Next

- Flows between whale wallets and exchanges (potential sell pressure vs. continued accumulation)

- Changes in the number of addresses holding >10,000 BTC and their on-chain clustering

- Macro and crypto-specific catalysts that could sustain or reverse accumulation trends

Conclusion

The sharp increase in holdings among Bitcoin Great Whales—including an added ~36,019 BTC—between October 24 and November 7 highlights notable large-holder conviction. Traders and analysts will be watching whether this accumulation phase persists and how it shapes liquidity and volatility across the broader crypto market.