Lead

Bitcoin’s short-term holder (STH) supply has climbed by about 1 million BTC since August to roughly 5.4 million BTC (+24.7%), signaling ongoing accumulation by newer market participants despite unrealized losses. The STH MVRV ratio hit a local low of 0.9124 on November 7 and has since stabilized to 0.9514, indicating potential relief if it holds above key thresholds.

Key Developments

- STH supply rose to approximately 5.4–5.44 million BTC, up by 1 million BTC since August.

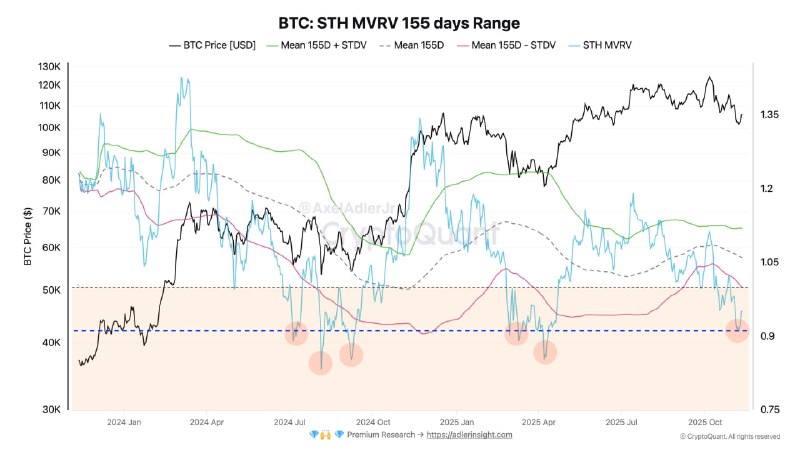

- STH MVRV (155-day) fell to 0.9124 on November 7, near the lower bound of its statistical range, then lifted to 0.9514.

- Analysts note that maintaining STH MVRV above 0.92 could pave the way for a move toward the upper end of the range, which may correspond to a BTC price of $115,000–$120,000.

What the Metrics Suggest

- Short-Term Holders (STH) are typically addresses holding coins for less than 155 days. A rising STH supply suggests new investor inflows and accumulation, even if many of these coins are currently at a loss.

- MVRV (Market Value to Realized Value) below 1 indicates that, on average, holders are underwater on their positions. Historically, STH MVRV rising from depressed levels toward or above 1 has aligned with improving market conditions.

If STH MVRV holds above roughly 0.92, analysts see room for a recovery toward the upper end of its range, potentially aligning with $115K–$120K scenarios.

Market Context

- Recent on-chain readings indicate that new investors are accumulating despite volatility and drawdowns, a behavior often seen during consolidation phases.

- Charts tracking STH supply, STH MVRV, and BTC price show that prior recoveries have tended to follow periods when STH MVRV approached its lower statistical band and then rebounded.

Looking Ahead

- Key thresholds to watch: STH MVRV 0.92 as a near-term floor and the 1.0 level as a sign of improving average profitability for recent buyers.

- Sustained growth in STH supply alongside a rising MVRV could support a constructive backdrop, while a break back below 0.92 would caution that downside risk remains.

Conclusion

On-chain data underscores a notable rise in short-term holder supply and an STH MVRV that is stabilizing after testing range lows. If these trends persist, they may bolster the case for a broader recovery, with some models pointing to an upper-range scenario near $115,000–$120,000. As ever, confirmation depends on MVRV holding key levels and continued evidence of net accumulation.