Lead

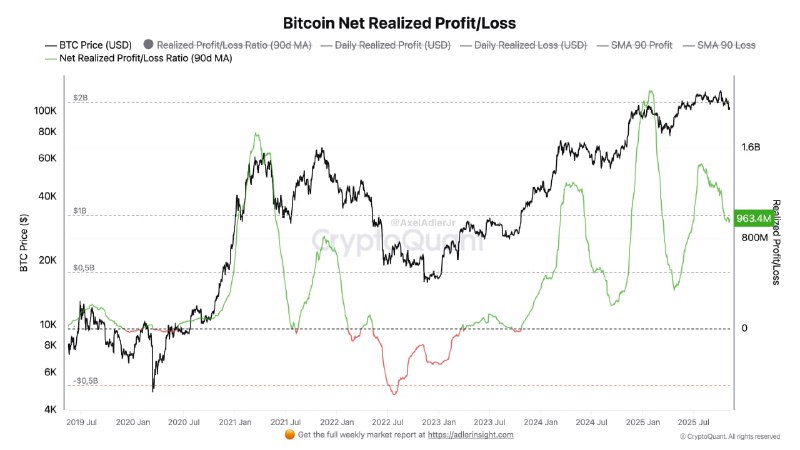

Bitcoin’s on-chain data indicates the network is realizing approximately $1 billion in profits per day on a 90-day average basis. A recent reading showed net realized profits around $963.2 million, underscoring elevated profit-taking as coins move above their cost basis.

Key Developments

- The metric tracked is Bitcoin Net Realized Profit/Loss, often visualized alongside the BTC price (USD).

- A 90-day moving average (SMA 90) smooths short-term volatility to reveal the trend in realized gains and losses.

- A recent data point highlighted $963.2 million in daily net realized profits, near the cited quarterly average of roughly $1 billion per day.

What the Metric Means

Net realized profit/loss measures the dollar value of gains or losses when bitcoins are spent on-chain relative to their last moved price (cost basis). When the metric turns strongly positive, it indicates:

- Holders are realizing gains at a significant pace.

- Coins are being transferred or sold at prices above their acquisition cost.

- Market liquidity is absorbing substantial profit-taking without a dramatic breakdown in price momentum.

Market Context and Implications

Sustained, elevated levels of realized profits are commonly seen during strong market phases, reflecting broad participation and high turnover of profitable supply. While this can signal healthy demand absorbing distribution from long-term holders, it also:

- Increases the chance of near-term volatility as sellers test market depth.

- Encourages profit-locking behavior, which can cap rallies if demand weakens.

- Acts as a barometer for market heat, helping traders gauge whether profit-taking pressures are intensifying or cooling.

Key Metrics at a Glance

- 90-day average daily net realized profit: ~$1B

- Recent highlighted daily value: $963.2M

Looking Ahead

Traders and analysts will be watching whether the 90-day moving average of net realized profits remains elevated or begins to roll over. Persistent high readings can indicate robust liquidity and continued market participation, while a sharp decline may point to cooling momentum or a shift toward loss realization.

As on-chain profit-taking remains substantial, risk management and close monitoring of realized profit/loss dynamics may help market participants navigate potential swings in BTC price behavior.