Lead

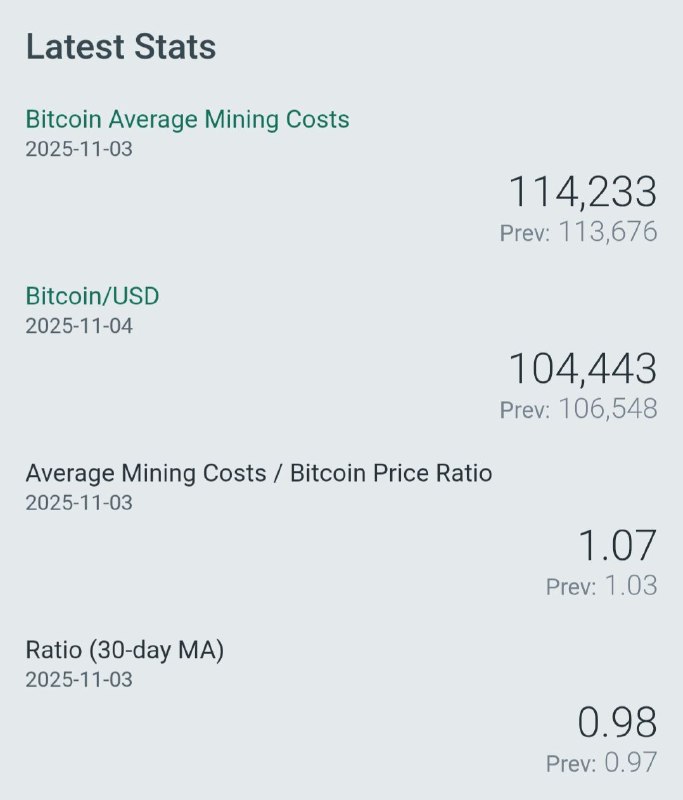

The average cost to mine one bitcoin climbed to $114,233 on November 4, 2025, surpassing the spot price of $104,443 and signaling a squeeze on miner margins. The mining cost-to-price ratio rose to 1.07, while the 30-day moving average of the ratio edged up to 0.98, indicating a recent and potentially short-term profitability crunch.

Key Developments

- Average mining cost (Nov 4, 2025): $114,233 (up from $113,676 on Nov 3)

- Bitcoin price (Nov 4, 2025): $104,443 (down from $106,548 on Nov 3)

- Mining cost/price ratio: 1.07 (up from 1.03)

- 30-day moving average ratio: 0.98 (up from 0.97)

These figures show the average cost of production moved decisively above market price on November 4, implying that, on average, miners faced negative margins at spot levels.

Why It Matters

When the average cost to produce BTC exceeds its market price, miner profitability compresses. In such periods:

- Operators with higher energy costs or less efficient hardware may temporarily power down equipment.

- Pressure can build for operational optimization, including energy hedging, hardware upgrades, or shifting to cheaper power sources.

- Sustained margin compression may influence hash rate and prompt difficulty adjustments, potentially stabilizing economics over time.

While the day’s ratio rose above 1.0, the 30-day moving average at 0.98 suggests the profitability squeeze is recent and has not yet been sustained over a longer period.

Market Impact

- A rising cost/price ratio can increase the likelihood of miner balance sheet stress, especially for highly leveraged or high-cost operators.

- Some miners may sell BTC reserves to fund operations, though responses vary widely across the industry and depend on individual cost structures.

- If elevated costs persist, the network could see hash rate fluctuations followed by difficulty retargets, potentially easing pressure on miners.

Looking Ahead

Traders and industry participants will watch whether the cost/price ratio remains above 1.0 and how the 30-day average evolves. Key indicators include:

- Bitcoin price trend relative to production costs

- Network hash rate and difficulty adjustments

- Transaction fee levels, which can supplement block rewards and support miner revenue

Short-term dislocations are not unusual in the mining cycle, but prolonged divergence between cost and price would heighten the focus on miner resilience and sector consolidation.