Lead

On-chain data indicates Bitcoin long-term holders (LTHs) are accelerating distribution, pushing their net position change into negative territory, while selling pressure from OG holders (coins held for over five years) has begun to ease. Market participants are defending the psychologically critical $100,000 level as larger entities absorb coins spent by smaller holders.

Key Developments

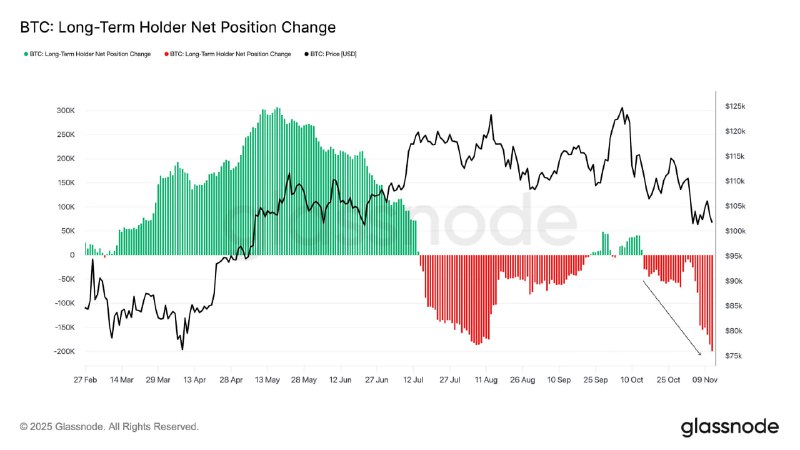

LTH distribution accelerates: Analytics show the supply held by long-term holders is shrinking as they realize profits, with the LTH net position change falling sharply below zero. This pattern typically emerges during late-stage uptrends when seasoned holders sell into strength.

OG holders eased recent selling: Veteran holders with coins aged >5 years capitalized on increased market liquidity to sell coins often acquired at prices well below $6,000. This cycle has seen an unusually strong inflow from OG cohorts, but the associated selling pressure has started to subside.

Flows to larger entities: Coins spent by smaller entities have been moving toward centralized exchanges, whales, and custodial wallets, suggesting profit-taking and liquidity-seeking behavior. Such flows can precede increased market-making activity and potential order book depth near key price levels.

On-Chain Context

The STXO (Spent Transaction Output) activity from OG holders has historically spiked around major bull market phases (e.g., late 2017, early 2021), aligning with heightened distribution as prices rally. Current-cycle readings indicate a comparable wave of OG spending that is now moderating.

The LTH Net Position Change metric flipping negative underscores an environment where long-term investors are increasingly sending coins to market, a dynamic often seen near strong resistance levels.

Cohort-based accumulation trends have historically rotated between accumulation and distribution phases. Recent patterns suggest a broadening shift toward distribution among older cohorts, while larger receivers consolidate flows.

Market Impact

With $100,000 acting as a defended zone, increased LTH and OG distribution may create near-term supply headwinds. However, the easing of OG selling pressure could reduce overhead supply if demand remains resilient.

The redirection of coins to exchanges and whales bears watching. Elevated exchange balances can signal potential sell-side liquidity, while whale accumulation can stabilize price action around key levels.

Conclusion

Bitcoin’s on-chain landscape reflects a classic late-cycle interplay: profit-taking by long-term cohorts alongside strong defense of a major psychological threshold. If OG selling continues to fade and larger entities absorb supply, volatility around $100,000 could set the tone for the next directional move. Traders should monitor LTH net position change, exchange inflows, and cohort flow trends for early signals of momentum shifts.