Lead

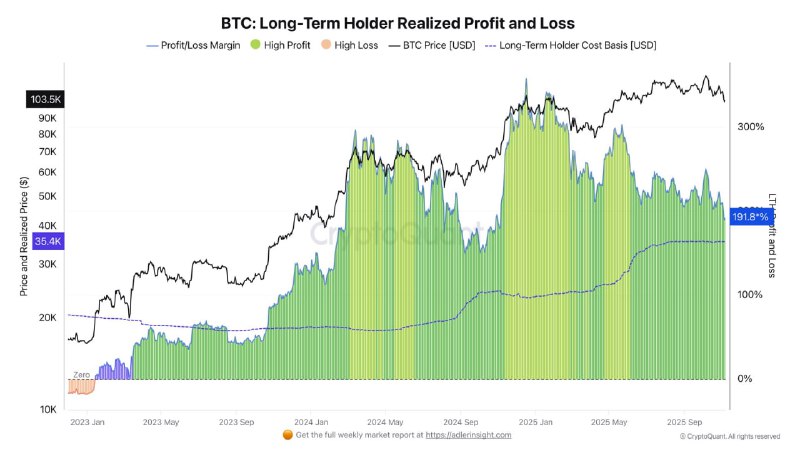

Long-term Bitcoin holders are sitting on an average profit of about 188%, with an estimated cost basis just over $35,000. The profitability metric has been declining and remains below prior cycle peaks of 296% and 346%, a setup that could temper selling as investors hold out for larger gains.

Key Metrics Now

- Average realized profit for long-term holders (LTH): 188%

- Estimated LTH cost basis: just over $35,000

- Recent on-chain charting indicates BTC price peaked around $103,500 during the current cycle

Lower realized profits may prompt long-term investors to slow sales in hopes of achieving higher returns as the cycle unfolds.

Context from Previous Cycles

Historical on-chain readings at prior market tops showed realized profits of roughly 296% and 346% for long-term holders. The current 188% figure sits well below those thresholds, suggesting the cycle may not yet reflect the profit levels typically associated with euphoric distribution phases.

Market Impact and Supply Dynamics

- A lower—but still substantial—profit cushion often reduces urgency to sell, potentially tightening available supply on exchanges.

- With a $35,000+ cost basis, long-term holders retain a meaningful buffer even after pullbacks, which can underpin market confidence.

- The observed decline in LTH realized profit suggests some cooling from recent highs, yet not to levels that historically trigger broad capitulation.

What to Watch

- Trajectory of LTH realized profit: A renewed rise toward prior-cycle ranges (near 300%+) could signal increasing distribution pressure.

- Price relative to LTH cost basis: Sustained price premiums over the $35,000 baseline keep long-term profitability intact.

- Market breadth and liquidity: If supply remains constrained while demand persists, price may revisit or exceed the recent peak near $103,500.

Conclusion

Long-term Bitcoin holders remain strongly profitable, but current realized gains of 188% are still well below previous cycle extremes. If this moderation persists, it could limit near-term selling pressure and shape a more measured distribution pace as the market tests higher levels.