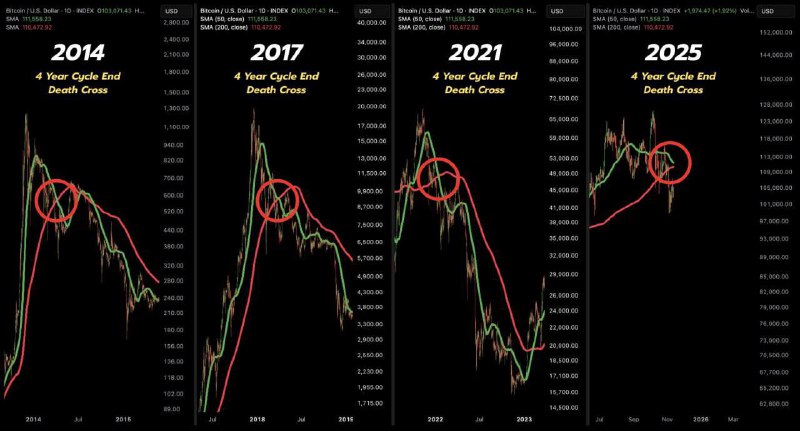

Bitcoin’s daily chart is approaching a potential death cross—a bearish signal where the 50-day moving average (MA) crosses below the 200-day MA. Similar setups preceded notable corrections in 2014, 2017, and 2021, fueling debate that the market could be nearing the end of its current four-year cycle if downside follows.

Key Developments

- A classic death cross on the daily timeframe—50-day MA crossing below the 200-day MA—has historically aligned with the end of Bitcoin bull cycles.

- This pattern was observed ahead of significant market pullbacks in 2014, 2017, and 2021.

- The current chart structure appears similar, suggesting a potential repeat of the historical cycle dynamics if weakness persists.

Why It Matters

Bitcoin’s market structure is often analyzed through the lens of a four-year cycle, anchored around the network’s halving events and subsequent bull and bear phases. While no single indicator is definitive, a confirmed death cross has historically:

- Coincided with waning bullish momentum near cycle ends

- Preceded multi-week to multi-month corrections

- Prompted broader risk-off moves across the crypto market

Technical Context

- The death cross is considered a lagging indicator; it reflects sustained weakness rather than predicting it outright.

- Confirmation typically comes from price action following the cross—continued lower lows strengthen the bearish case, while swift recoveries can reduce its relevance.

- A counter-signal would be a strong rebound that reclaims both moving averages and later prints a golden cross (50-day MA crossing back above the 200-day MA).

Market Impact

If confirmed, the signal may encourage cautious positioning among traders and algorithmic strategies that incorporate trend filters. Historically, such crossovers have:

- Increased short-term volatility

- Pressured high-beta altcoins more than Bitcoin

- Elevated focus on risk management and liquidity

Outlook

Traders are watching the daily 50- and 200-day moving averages for confirmation. A sustained pullback would reinforce the idea that the four-year cycle top may be in, while a robust recovery could invalidate the setup. Until then, technical risk remains elevated, and market participants are likely to favor disciplined positioning over aggressive risk-taking.