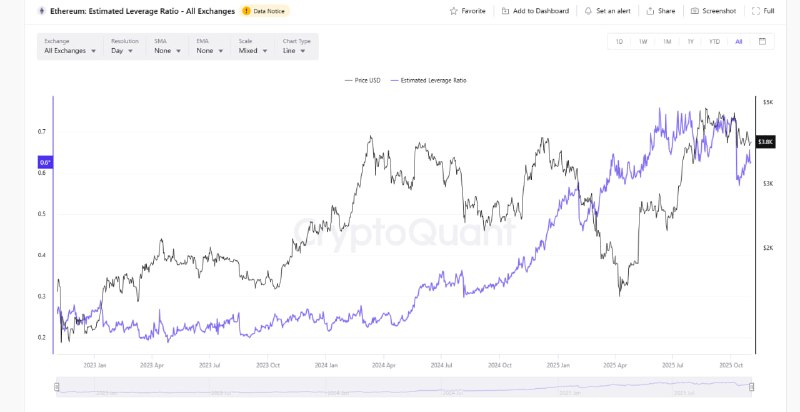

The estimated leverage ratio for Bitcoin (BTC) and Ethereum (ETH) across major cryptocurrency exchanges offers a snapshot of risk appetite in derivatives markets. While readings vary by platform, the metric is closely watched for signs of crowded positioning and the potential for volatility.

What the estimated leverage ratio measures

- The estimated leverage ratio (ELR) is commonly used by analytics firms to gauge how much leverage traders are employing relative to available spot holdings on exchanges.

- Higher ELR levels suggest that a greater share of market activity is driven by leveraged positions, which can increase sensitivity to price swings and liquidation cascades.

- Lower ELR levels indicate a more conservative backdrop with reduced leverage risk.

Why it matters for BTC and ETH

- Bitcoin and Ethereum lead crypto derivatives activity, making their ELR a bellwether for broader market risk.

- Elevated ELR does not indicate bullish or bearish direction by itself; instead, it highlights the intensity of leverage that may amplify moves either way.

- Shifts in ELR across exchanges can reflect changing market structure, including differences in funding rates, margin requirements, and trader positioning.

How traders use the metric

- Combine ELR with other indicators such as open interest, funding rates, spot inflows/outflows, and options skew to assess market health.

- Watch for sudden spikes or drops in ELR across multiple exchanges, which can precede volatility and liquidation events.

- Consider exchange-specific nuances: margin systems, liquidity depth, and funding mechanisms can cause ELR to differ by venue.

Key takeaways

- ELR is a risk signal, not a directional indicator.

- Elevated leverage can amplify both rallies and drawdowns.

- Cross-referencing ELR for BTC and ETH across exchanges helps identify where leverage is concentrated and how it might impact short-term price dynamics.

Conclusion Estimated leverage for Bitcoin and Ethereum across exchanges remains a critical gauge of market risk. Monitoring changes alongside funding, open interest, and liquidity conditions can help traders anticipate periods of elevated volatility and manage exposure accordingly.