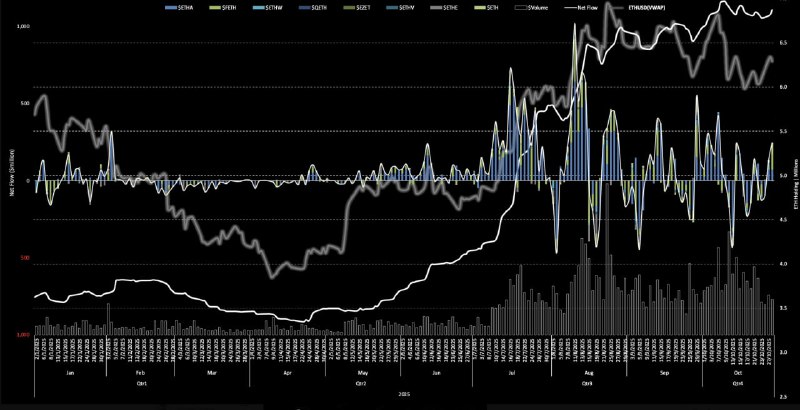

Traders are closely watching estimated leverage for Bitcoin and Ethereum across major crypto exchanges. This metric, derived from derivatives positioning relative to spot reserves, helps assess market risk and the potential for liquidation cascades.

What is estimated leverage?

- Estimated leverage (often referred to as an estimated leverage ratio) is commonly defined as futures open interest denominated in the asset divided by the asset’s spot reserves held on exchanges.

- In practical terms, it gauges how much leverage is being used in derivatives compared to the available underlying coins on platforms, offering a snapshot of systemic leverage in the market.

Why it matters

- Rising estimated leverage suggests more aggressive use of margin and derivatives, which can amplify price swings.

- Elevated leverage can increase the likelihood of liquidation events if the market moves sharply against crowded positions.

- Falling leverage typically signals deleveraging and can correspond with lower near-term volatility.

How exchanges can differ

- Perpetual swaps vs. dated futures: Perpetual contracts often drive real-time funding dynamics, while dated futures can reflect term structure (contango/backwardation).

- Margin currency: USDT/USDC-margined vs. coin-margined contracts can influence liquidation thresholds and behavior.

- Participant mix: Some venues skew toward market makers and professionals, others toward retail, shaping leverage profiles.

- Reserve management: Exchange inflows/outflows of BTC or ETH impact the denominator of the metric and can affect readings even without major changes in open interest.

Bitcoin vs. Ethereum patterns

- Leverage profiles can diverge between BTC and ETH due to differences in liquidity, event-driven catalysts, and basis conditions.

- Ethereum’s derivatives activity may fluctuate around network upgrades or ecosystem milestones, while Bitcoin can see shifts around macro events and market-wide risk sentiment.

How traders use the metric

- Risk management: Identify periods of elevated leverage that may precede volatility or liquidation cascades.

- Cross-check with other indicators: Funding rates, open interest changes, basis (futures vs. spot), and realized/expected volatility.

- Context with price action: Rising leverage with accelerating prices can indicate crowded momentum; rising leverage into a drawdown can signal heightened squeeze risk.

Signals to watch

- Rising leverage + positive funding + strong uptrend: Greater risk of long liquidation if momentum reverses.

- Rising leverage + negative funding + downtrend: Greater risk of short squeeze if price bounces.

- Sudden exchange reserve changes: May distort the ratio; confirm with on-chain or exchange transparency data.

Key caveats

- Not a directional signal on its own; leverage can increase due to hedging, market making, or basis trades.

- Exchange-level differences mean aggregate views may mask venue-specific risks.

- Short-term spikes can be transitory; look for sustained trends and confirmation from multiple indicators.

Conclusion

Monitoring estimated leverage for Bitcoin and Ethereum across exchanges provides a useful lens on systemic risk and potential volatility. While it can highlight conditions for squeezes or rapid price moves, it should be used alongside funding rates, open interest, basis, liquidity, and price structure for a more complete market view.