Lead

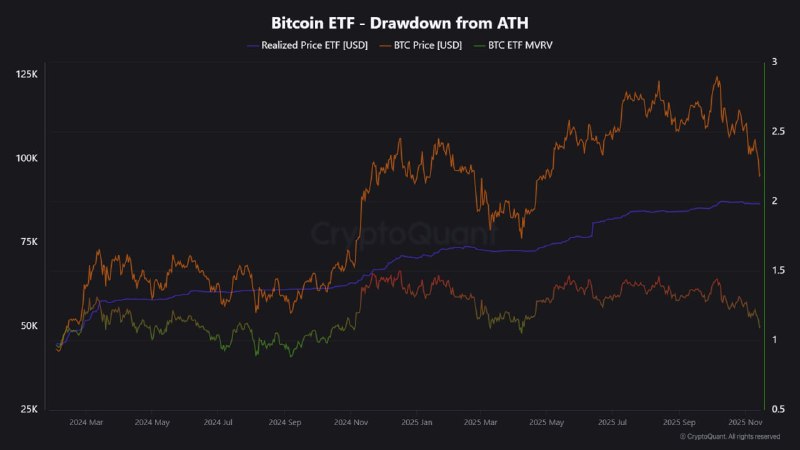

The average realized price for Bitcoin held by spot ETFs has climbed to $86,680, while Bitcoin continues to trade about 9% above the average cost basis of ETF buyers. Recent metrics show ETF-focused MVRV oscillating between 2.0 and 3.0, with BTC price peaking around mid-2025 before easing into the second half of the year.

Key Metrics

- Realized Price (ETF): $86,680

- BTC vs. ETF Cost Basis: Bitcoin remains roughly 9% higher than ETF investors’ average acquisition price

- ETF MVRV: Fluctuating in the 2.0–3.0 range

- Timeline: Data spans March 2024 to November 2025

- Trend Profile: BTC price peaked around mid-2025, then trended lower, while ETF realized price advanced steadily with lower volatility

Context and Interpretation

- The ETF realized price reflects the aggregate cost basis of Bitcoin held by spot ETFs. Trading above this level indicates unrealized gains for ETF holders on average.

- The MVRV ratio (market value to realized value) hovering between 2.0 and 3.0 suggests market valuations have consistently sat above cost basis, though with notable swings.

- A chart labeled "Bitcoin ETF – Drawdown from ATH" indicates that despite a mid-2025 price peak and subsequent drawdown, the ETF realized price trended upward, implying continued net inflows or higher-cost accumulation through the period.

Market Impact

- With BTC roughly 9% above the ETF cohort’s average cost basis, ETF holders remain in profit on aggregate, a setup that can influence investor behavior around key levels such as the realized price.

- The ETF realized price often acts as a psychological pivot: sustained trading above it can underpin risk appetite, while a breakdown below may signal broader stress among recently accumulated positions.

Looking Ahead

Investors are watching whether BTC can maintain its buffer over the $86,680 ETF realized price and how the MVRV range evolves. A decisive move in either direction could shape near-term momentum as markets assess the durability of ETF-driven demand into late 2025.