Lead

Bitcoin fell below $105,000, triggering a wave of liquidations totaling $1.33 billion across 333,294 traders in the last 24 hours. On-chain flows point to short-term holder capitulation, with 28,600 BTC (about $2.98 billion) sent to exchanges at a loss amid heightened volatility.

Key Developments

- Price slide: Bitcoin moved below $105,000, intensifying downside pressure.

- Liquidations surge: $1.33B in positions were liquidated across 333,294 traders in 24 hours.

- Largest single wipeout: The biggest individual liquidation was on HTX (pair

BTC-USDT) for $47.87 million. - STH capitulation: 28,600 BTC transferred to exchanges at a loss by short-term holders (STH), signaling risk-off behavior.

Market Impact

The combined spike in liquidations and exchange inflows underscores a risk-driven environment where leveraged positions are being washed out. The outsized single liquidation on HTX highlights concentrated risk in high-leverage markets during rapid price moves. Elevated exchange inflows from STH cohorts typically reflect mounting sell-side pressure and short-term pessimism.

Whale Activity

- A well-known whale trader, Machi Big Brother, was reportedly liquidated to nearly zero, with an account balance reduced to $16,771.

- Cumulative losses attributed to these liquidations exceeded $15 million.

While individual whale events do not determine broader price trends, they often mirror wider liquidity stress during sharp drawdowns.

Sentiment and Technical Context

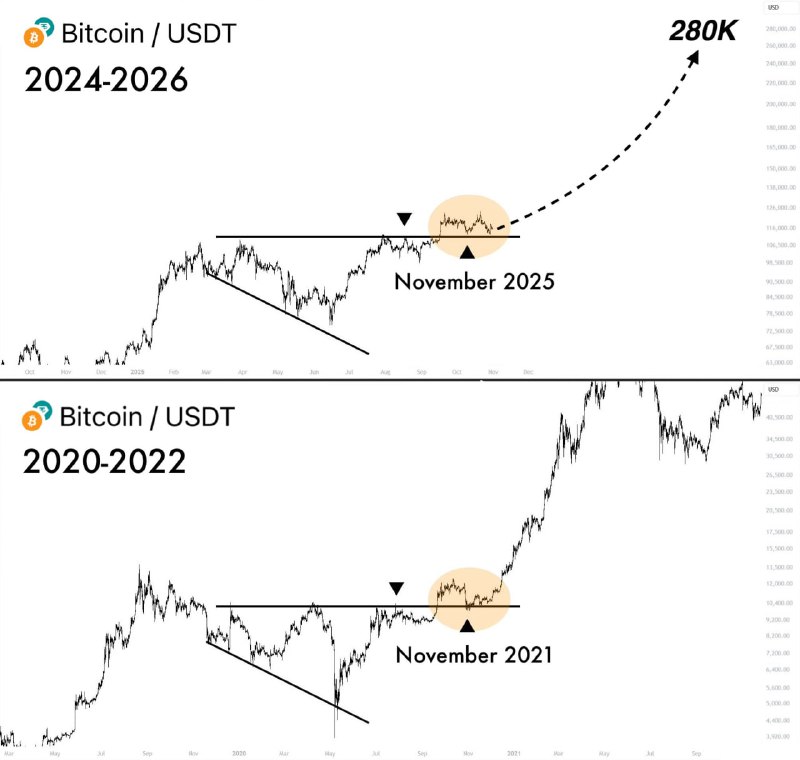

Some market commentators have drawn parallels between the current cycle and prior expansions, suggesting that if similar patterns hold, a later expansion phase could propel Bitcoin toward $280,000. However, such projections remain speculative, and near-term dynamics are dominated by liquidation cascades, exchange inflows, and risk management by leveraged traders.

Conclusion

Bitcoin’s dip below $105,000 coincided with heavy liquidations and clear signs of short-term holder capitulation, reinforcing a defensive market posture. Traders are watching exchange inflows, liquidity conditions, and derivatives positioning for clues on whether selling pressure will persist or stabilize in the sessions ahead.