Lead

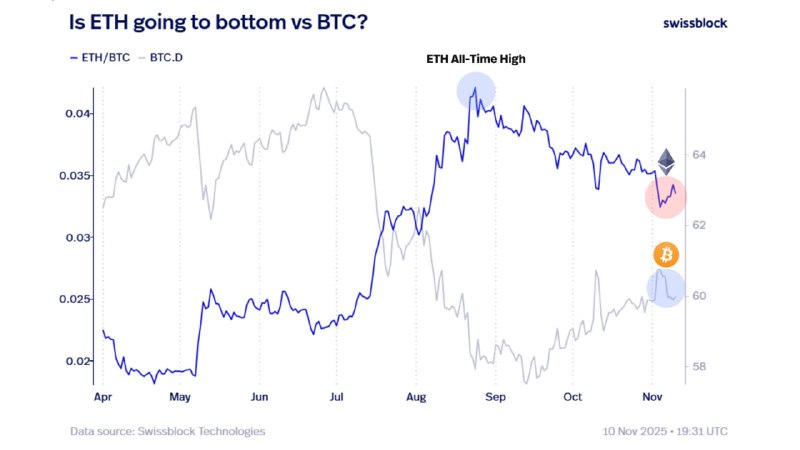

Ethereum’s performance against Bitcoin has deteriorated steadily since late August, but fresh data suggests a potential turning point. As of November 10, 2025, the ETH/BTC ratio has fallen toward 0.035, while Bitcoin dominance shows signs of exhaustion—often a precursor to capital rotating from BTC into Ethereum and altcoins.

Key Developments

- The ETH/BTC pair surged above 0.07 in August before entering a persistent decline to around 0.035 by early November.

- Bitcoin dominance (BTC.D) has been relatively stable through April–November with minor fluctuations, but recent data indicates it may be peaking or losing momentum.

- Historically, peaks in BTC dominance often align with local bottoms for ETH/BTC, signaling the early stages of potential rotation into ETH and other altcoins.

Technical Context

Data visualized on November 10, 2025 (19:31 UTC), indicates the following trajectory:

- From April to August, ETH/BTC climbed from roughly 0.0325 to just above 0.07.

- Since late August, the pair has trended downward to approximately 0.035.

- Over the same period, BTC dominance remained firm but is now showing signs of fatigue, hinting at a possible inflection.

The relationship between these metrics is critical: if BTC dominance tops out, the probability of ETH stabilizing versus BTC historically increases, potentially catalyzing a broader altcoin rotation. The latest readings, derived from analytical datasets attributed to Swissblock Technologies, align with this rotational thesis.

Market Impact

- A confirmed bottom in ETH/BTC could shift market leadership away from Bitcoin, boosting Ethereum and broader altcoins.

- Traders often monitor ETH/BTC as a proxy for risk appetite within crypto; stabilization or reversal can precede stronger altcoin performance.

- Should BTC dominance continue to fade, capital may increasingly flow into higher-beta crypto assets.

What to Watch

- Confirmation of a local top in BTC dominance over the coming sessions.

- A sustained ETH/BTC hold above recent lows near 0.035 and any higher-low structure forming on the ratio.

- Liquidity rotation into ETH and key altcoin sectors if momentum follows through.

Conclusion

With ETH/BTC near multi-month lows and BTC dominance showing signs of fatigue, conditions are aligning for a potential rotation from Bitcoin into Ethereum and altcoins. A confirmed shift will likely depend on whether BTC dominance decisively rolls over and ETH/BTC establishes a durable base in the coming days and weeks.