Lead

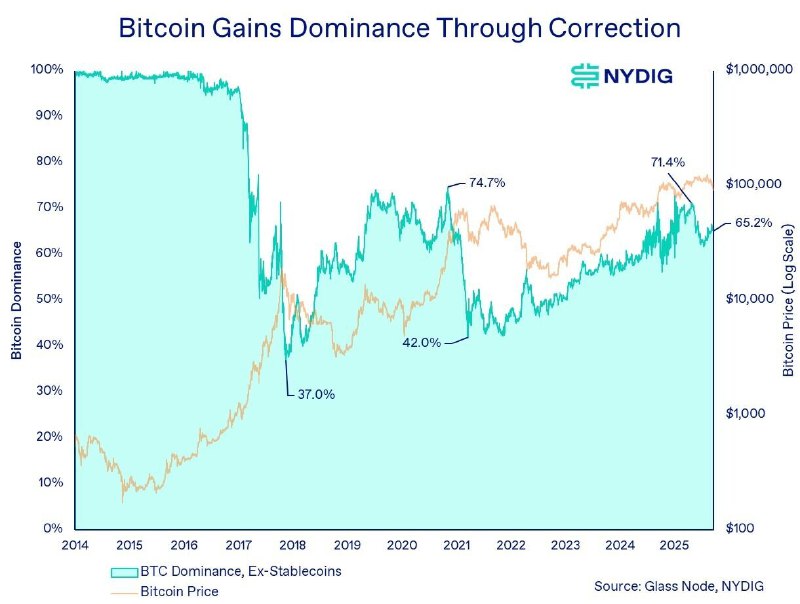

Bitcoin’s market dominance climbed above 60% in early November and has stabilized around 59% as capital consolidates into BTC during market downturns, according to analysis shared by NYDIG. The data indicates Bitcoin’s share of the crypto market tends to rise during corrections as investors seek relative safety in the largest digital asset.

Key Developments

- BTC dominance (ex-stablecoins) rose past 60% before settling near 59%.

- Analysis highlights a recurring pattern: Bitcoin gains market share during corrections, while altcoins typically underperform.

- Historical context from long-term charts shows prior cycle extremes, with BTC dominance peaking near 74.7% in 2017 and hitting multi-year lows around 37%–42% during risk-on altcoin cycles.

- The NYDIG chart applies a logarithmic Bitcoin price scale alongside dominance, underscoring BTC’s long-term appreciation while illustrating cyclical shifts in market share.

Market Context

The increase in dominance suggests a risk-off rotation within crypto, where traders and institutions reduce exposure to smaller-cap altcoins and concentrate holdings in BTC during volatility. The metric cited excludes stablecoins to better reflect the relative performance of volatile cryptoassets.

“Bitcoin gains dominance through correction,” notes the NYDIG analysis framing, pointing to historical periods where BTC outperformed the broader market during drawdowns.

Why It Matters

- Investor positioning: Rising dominance often signals participants seeking liquidity and depth, reinforcing Bitcoin’s role as the crypto market’s benchmark asset.

- Altcoin pressure: Sustained BTC outperformance can weigh on altcoin market share and funding conditions until risk appetite returns.

- Cycle signals: Shifts in dominance are watched as indicators of where we are in the market cycle, informing allocation and risk management.

Looking Ahead

Traders will watch whether BTC dominance holds near current levels or retreats as risk appetite improves. A continued consolidation near 59%–60% could indicate prolonged caution toward altcoins, while a reversal may hint at a renewed altcoin rotation if market conditions stabilize.

For additional context on market structure and dominance trends, refer to NYDIG’s research resources at nydig.com.