Lead

Bitcoin’s sell-off deepened as the price briefly slipped below $82,000, triggering a fresh wave of leveraged unwinds. Over the last 24 hours, crypto markets saw up to $1.9 billion in liquidations, while U.S. spot Bitcoin ETFs logged $903 million in net outflows on November 20, the second-largest daily withdrawal since their launch in January 2024.

Key Developments

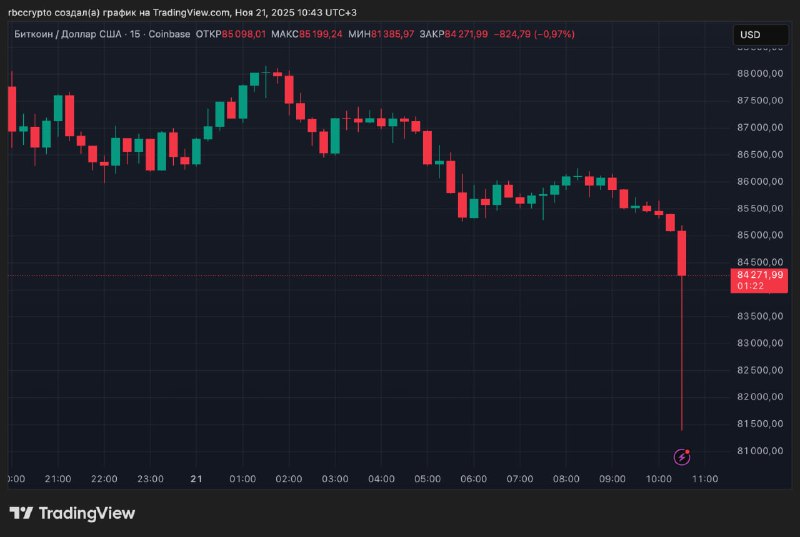

- Bitcoin updated local lows overnight, first dipping below $86,000 and later briefly under $82,000 before stabilizing around the $85,000–$86,000 range.

- Market sentiment has been mired in a prolonged stretch of fear, coinciding with accelerating sell pressure during recent U.S. trading sessions.

Liquidations Surge

Data from market dashboards showed a sharp spike in forced unwinds:

- 24h liquidations: up to $1.91 billion, with approximately $1.78 billion from long positions.

- 12h: about $1.20 billion; 4h: about $1.01 billion; 1h: roughly $966 million at peak.

- Separate trackers reported between ~252,000 and ~400,000 traders affected over 24 hours.

- The largest single order flagged on one venue was $30.91 million on the HTX BTC-USDT pair, while another platform saw a forced closure reported at $37 million on Hyperliquid.

Recent spot readings illustrated the slide, with BTC/USDT near $86,077 (-0.65%) and BTC/USD around $85,615 at approximately 09:35 UTC+2, after a sharp intraday drop.

ETF Flows Turn Sharply Negative

- U.S. spot Bitcoin ETFs recorded $903 million in net outflows on November 20, the second-largest single-day withdrawal since the products debuted in January 2024.

- The outflows added to selling pressure during the U.S. sessions for a second consecutive week, according to market activity patterns.

Market Impact

- Bitcoin is trading around $85,000, roughly 33% below its all-time high and about 7% lower than levels at the start of 2025.

- Broad crypto benchmarks turned lower, with some top-100 altcoins dropping 10–15% in the past day.

- In the latest 24-hour window, liquidations approached $1 billion again across venues, with traders positioned for upside losing approximately $830 million on net.

Outlook

Volatility remains elevated as leverage resets and ETF flows weigh on sentiment. Traders are watching whether the $82,000–$86,000 band can hold, alongside the trajectory of U.S. spot ETF flows, for clues on near-term direction.