Lead

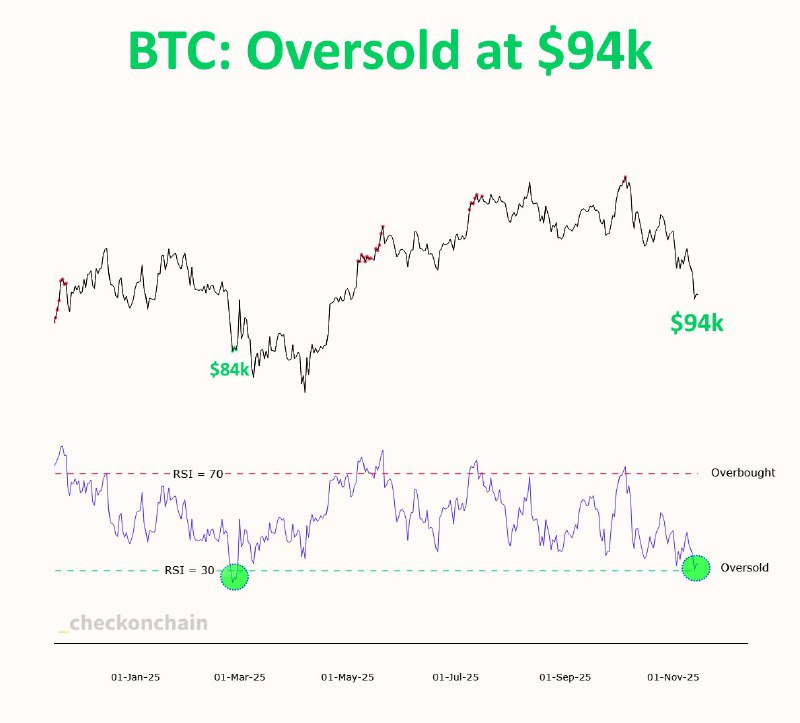

Bitcoin’s one-day Relative Strength Index (RSI) fell to its most oversold reading in the past year, hovering near the 30 threshold as the price traded around $94,000. The signal underscores mounting short-term selling pressure and sets the stage for either a technical bounce or continued volatility.

Key Developments

- The 1-day RSI for BTC has dropped to roughly the 30 mark, a level commonly viewed as oversold in technical analysis.

- Visual market data accompanying the move highlighted Bitcoin at approximately $94,000, with a prior reference point marked near $84,000.

- Standard RSI zones remain in focus: 30 denotes oversold conditions and 70 overbought.

Why It Matters

The RSI is a momentum oscillator that measures the speed and magnitude of price changes. Readings near 30 typically indicate the market may be oversold, suggesting the potential for a short-term relief rally. However, oversold signals are not guarantees of an immediate reversal; they can persist during strong downtrends, and price can continue to weaken even as RSI remains depressed.

In previous cycles, deeply oversold daily RSI prints often preceded short-lived rebounds, but the durability of any recovery depended on broader market liquidity and macro risk sentiment.

Technical Context

- An RSI near 30 reflects elevated selling pressure over the recent period and a potential exhaustion of momentum to the downside.

- If buyers defend price levels around the $94,000 zone, a mean-reversion bounce toward intermediate resistances is plausible.

- Conversely, failure to hold support could see BTC retest lower marked levels, such as the prior $84,000 reference indicated on recent chart annotations.

Market Outlook

Traders will watch for confirmation signals—such as bullish divergences on momentum indicators, rising volume on up-days, or reclaiming short-term moving averages—to gauge whether the oversold reading translates into a rebound. Until then, volatility risk remains elevated, and positioning around key support and resistance levels will likely drive near-term price action.

Conclusion

Bitcoin’s daily RSI hitting its most oversold level in a year places technical conditions at an inflection point. A swift recovery or further downside follow-through will hinge on whether buyers step in decisively at current levels around $94,000 and how broader market sentiment evolves in the days ahead.