Lead

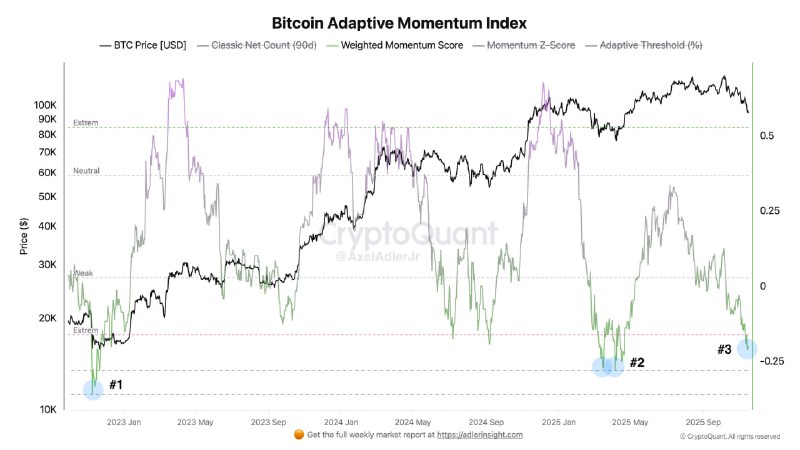

An analyst spotlighted Bitcoin’s Adaptive Momentum Index, emphasizing that higher readings imply a more sustainable bullish trend, while negative values signal prolonged bearish pressure. The latest dashboard groups multiple momentum gauges, encouraging comparisons between current and prior cycle readings.

Key Takeaways

- Positive momentum: Sustained high values suggest a durable uptrend

- Negative momentum: Sub-zero readings often align with extended drawdowns

- Comparative view: Current signals can be assessed against prior cycle turning points

“The higher the value, the more sustainable the bullish trend; negative values indicate prolonged bearish pressure.”

How the Indicator Works

The Adaptive Momentum framework uses a composite approach to track trend strength:

- Weighted Momentum Score to gauge the intensity of moves

- Momentum Z-Score to contextualize momentum versus historical norms

- Classic Net Count (90d) to smooth and aggregate momentum over a multi-month window

- An Adaptive Threshold (4%) to filter signals, with zones often labeled Neutral and Extreme for clarity

Together, these components provide a structured way to determine whether momentum is building or fading, and to identify pivotal moments where trends can accelerate or reverse. Several marked inflection points on the dashboard highlight historical transitions between bullish and bearish regimes.

Market Implications

For traders and analysts:

- A sustained move above the adaptive threshold strengthens the case for a continued uptrend and may support trend-following strategies.

- A rollover toward negative territory can warn of weakening demand and the risk of a more prolonged downturn.

- Comparing current readings with previous cycles can help frame expectations and calibrate risk management across time horizons.

Looking Ahead

Market participants are watching whether momentum can remain firmly positive to validate bullish continuation. Conversely, a slide into negative readings would raise the probability of extended bearish pressure, keeping volatility and risk management front of mind.