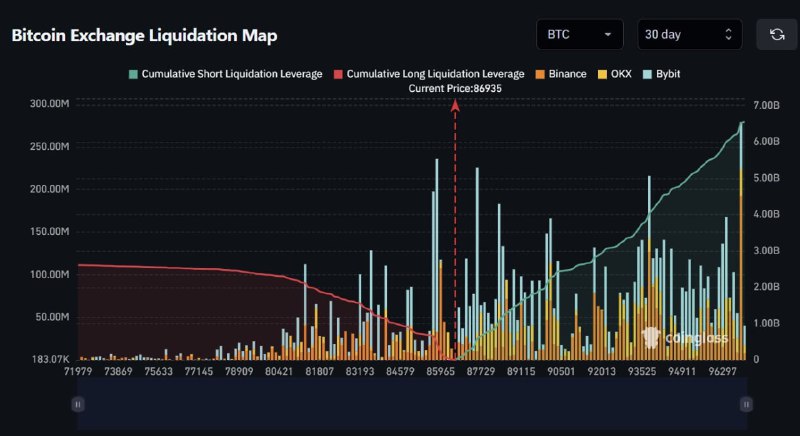

Bitcoin continued to trade around $87,000 as liquidity maps indicated the potential for a sharp move. Market attention centered on the possibility of roughly $6 billion in short liquidations if price accelerates toward $97,000, alongside macro trade-policy developments, security risks, and fresh commentary from industry leaders.

Key Developments

- Bitcoin near $87K: The benchmark cryptocurrency remained stable around the $87,000 level. Liquidity heatmaps indicate a cluster of short positions above $97,000, suggesting a move into that range could trigger up to $6 billion in forced liquidations.

- JPMorgan backlash chatter: Some crypto participants discussed boycotting JPMorgan following reports that certain crypto-linked names could be excluded from top equity indices, stoking debate over Wall Street's stance toward digital assets.

- VanEck on quantum risk: The CEO of VanEck said Bitcoin remains vulnerable to quantum technologies, reviving discussion about the long-term resilience of current cryptography and the industry’s preparedness for quantum-era threats.

- Vitalik Buterin on FTX: Ethereum co-founder Vitalik Buterin described FTX as a counterexample that runs against the principles of Ethereum, underscoring ongoing reflections on centralized failures versus decentralized ethos.

Macro and Policy

- Tariff contingency planning: The U.S. administration is preparing a backup plan in case the Supreme Court blocks certain tariffs, exploring options under Sections 301 and 122 of trade law that could allow the president to impose tariffs without congressional approval. The discussion adds a macro layer that risk markets, including crypto, are monitoring for potential knock-on effects.

Security and Infrastructure

- Workforce infiltration concerns: A new study claims North Korean-linked actors are present in 15–20% of global crypto companies and that 30–40% of job applications in the sector are fraudulent. The findings highlight persistent hiring risks and the need for stronger identity verification and vendor due diligence across the industry.

Market Movers

Among notable 24-hour movers:

- Canton — $0.08494 (↑ 12.94%)

- Hedera (HBAR) — $0.1469 (↑ 8.51%)

- Story Protocol — $2.39 (↑ 6.71%)

Outlook

Short-term momentum hinges on whether Bitcoin can approach the $97,000 region to test the thick band of short liquidity. Beyond price action, traders are watching U.S. trade policy maneuvers, bank-industry positioning toward crypto, and evolving cybersecurity threats—all factors that could shape risk appetite into the week ahead.