Lead

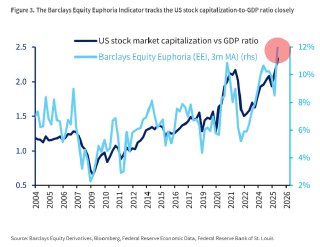

The Barclays Equity Euphoria Index has surged to its highest level on record, approaching 12% on a three-month moving average, signaling elevated risk appetite in stock markets. A companion chart shows the US stock market capitalization-to-GDP ratio hovering near historic highs, around 2.5 in recent years—conditions that often shape sentiment across risk assets, including cryptocurrencies.

Key Developments

- The Barclays Equity Euphoria (EEI, 3m MA) has climbed to a record, near 12%, indicating intensified bullish enthusiasm in equities.

- The US market cap-to-GDP ratio remains elevated (around 2.5 in recent years), underscoring historically rich valuations alongside rising euphoria.

- The figure compares these two measures over roughly the past two decades, highlighting how peaks in euphoria often coincide with lofty equity valuations.

While the EEI is designed to track equity market exuberance, its three-month smoothing suggests the current upswing is broad-based rather than a short-lived spike. Elevated readings historically align with risk-on periods but can also precede higher volatility when sentiment reverses.

Market Impact

- For crypto investors, a high euphoria backdrop in equities can translate into stronger risk appetite for digital assets such as Bitcoin and altcoins.

- However, extreme euphoria can also be a late-cycle signal; if sentiment cools or macro conditions tighten, correlations with equities may expose crypto to turbulence.

What to Watch

- Sustainability of the EEI near record levels over the coming weeks.

- Shifts in the market cap-to-GDP ratio that might indicate valuation compression.

- Broader macro cues—liquidity conditions, interest rate expectations, and risk events—that could influence cross-asset sentiment.

Conclusion

A record-high Barclays Equity Euphoria Index and persistently elevated market cap-to-GDP ratio point to a powerful risk-on environment. For crypto markets, that backdrop can be supportive—but with sentiment stretched, traders should remain alert to potential swings if euphoria fades.