A reported exploit involving Balancer has drawn attention to a Polymarket contract that pays out if there is another crypto hack of at least $100 million in 2025. Traders who backed the "Yes" outcome could profit if the incident meets the market’s rules for verification and timing.

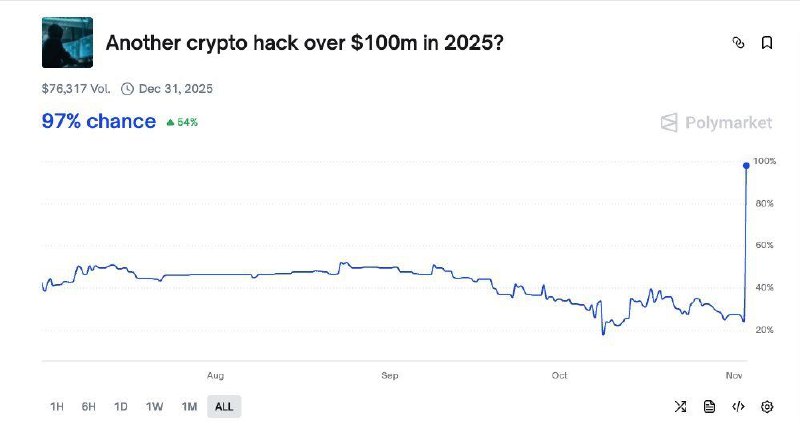

Polymarket, a prediction market platform, lists event-driven markets that resolve based on publicly verifiable outcomes. One active contract asks whether there will be "another crypto hack of at least $100 million in 2025." Following news of the Balancer incident, market participants are watching for confirmation on the scope of losses and whether the event qualifies under the contract’s resolution criteria.

Resolution typically hinges on factors such as the incident date, the type of security breach involved, the total value compromised, and independent verification from recognized sources. If the Balancer exploit is confirmed to meet the $100 million threshold and timing requirements, it could trigger a payout to "Yes" holders on the market.

Large-scale exploits remain a persistent risk in decentralized finance, where complex smart contract interactions and liquidity pools can create attack surfaces for sophisticated actors. Prediction markets like Polymarket allow traders to express views on the likelihood and impact of such events, translating real-time risk into market prices.

If validated under the contract’s terms, the Balancer incident could become a decisive catalyst for the 2025 crypto hack wager—highlighting the tight linkage between on-chain security events and event-driven trading.