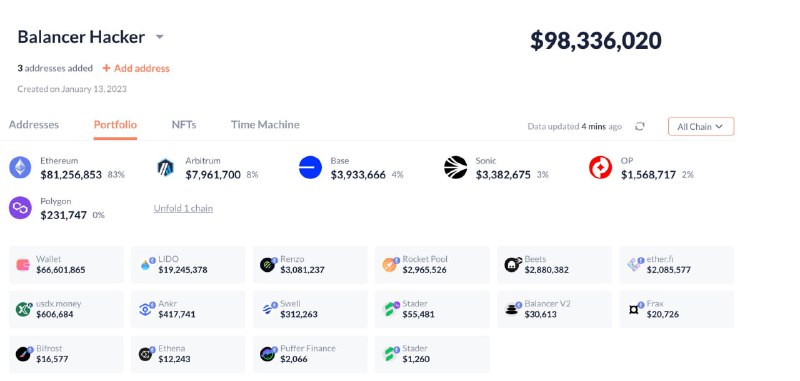

Decentralized finance protocol Balancer appears to be under an active exploit, with at least $70 million in assets siphoned and total outflows potentially exceeding $100 million. On-chain data show large transfers of wrapped ether and staking derivatives from a Balancer-linked address to external wallets across multiple networks. The project team has not publicly commented at the time of writing.

Initial tallies indicate the attacker moved a mix of wrapped and staked ether tokens, including:

- 6,587 WETH (approximately $24.5 million)

- 6,851 osETH (approximately $26.9 million)

- 4,260 wstETH (approximately $19.3 million)

Additional assets were also transferred, and tracking dashboards continue to update as activity progresses. Some on-chain monitors now place gross outflows above $110 million as transactions continue, suggesting the final loss figure could rise.

The transfers originated from one Balancer address and were routed to external wallets in quick succession, indicating a coordinated drain. The nature of the vulnerability and whether it spans multiple chains or deployments has not yet been disclosed.

Launched in 2020, Balancer is a prominent automated market maker and portfolio management protocol. It has attracted more than $350 million in total value locked (TVL) on the Ethereum network alone.

With the incident still unfolding, users and liquidity providers are awaiting an official statement and remediation plan. Further updates are expected as investigators trace the flows and the team assesses impact across pools and networks.