Lead

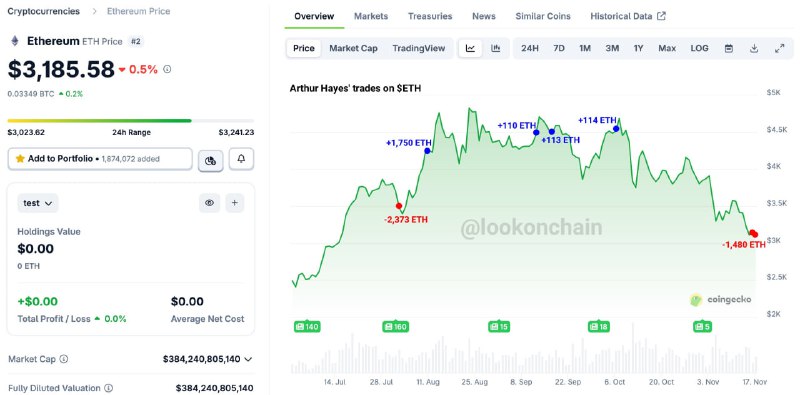

Crypto figure Arthur Hayes has offloaded a package of Ethereum and altcoins worth about $7.4 million over the past two days, on-chain data indicates. The sales include 1,480 ETH (~$4.7M) and several Ethereum ecosystem tokens. Hayes also transferred 320,000 LDO (~$239,000) to market maker Wintermute, as ETH traded near $3,185 with a 24-hour gain of about 3%.

Key Developments

- ETH sales: 1,480 ETH (approximately $4.7M)

- Altcoin disposals:

- ENA: 5,000,000 ENA (approximately $1.38M)

- LDO: 960,000 LDO (approximately $718,100)

- AAVE: 1,630 AAVE (approximately $288,700)

- UNI: 28,670 UNI (approximately $208,700)

- ETHFI: 132,730 ETHFI (approximately $124,200)

- Additional transfer: 320,000 LDO (~$239,000) sent to Wintermute (Wintermute)

Cumulatively, the token sales total about $7.4 million across the Ethereum ecosystem over two days, with a separate LDO transfer to Wintermute that may indicate liquidity management or off-exchange positioning by the market maker.

On-Chain Details

- The activity has been linked to a wallet attributed to Hayes:

0x6cd66dbdfe289ab83d7311b668ada83a12447e21. - Transaction logs show a series of ETH and ERC-20 movements, including multiple transfers in the low-thousands of ETH range, alongside the altcoin sales and the 320,000 LDO transfer to Wintermute.

Market Context

At the time of the observed activity, Ethereum (ETH) traded around $3,185.58, up roughly +3.02% over 24 hours, according to market dashboards such as CoinGecko. The tokens sold—ENA, LDO, AAVE, UNI, and ETHFI—are prominent within the Ethereum ecosystem and are commonly used for governance, liquidity provisioning, or protocol incentives.

Hayes has previously sold ETH and later repurchased at higher prices in past episodes, though his latest series of transactions does not, by itself, indicate a directional view. Large, visible flows from well-known market participants can influence sentiment, but immediate price impacts are often diffuse across venues and liquidity pockets.

What to Watch

- Further on-chain movements from the wallet above, particularly additional transfers to market makers or exchanges

- Short-term liquidity and order book depth in LDO, ENA, AAVE, UNI, and ETHFI following the disposals

- Any subsequent repurchases that would mirror Hayes’s prior trading patterns

Conclusion

Hayes’s two-day repositioning—fronted by $4.7M in ETH sales and multi-million-dollar altcoin disposals—adds a notable data point to Ethereum market flows. The additional LDO transfer to Wintermute suggests ongoing liquidity management. Traders will be monitoring the wallet and related venues for signs of continued selling or potential re-accumulation.