Lead

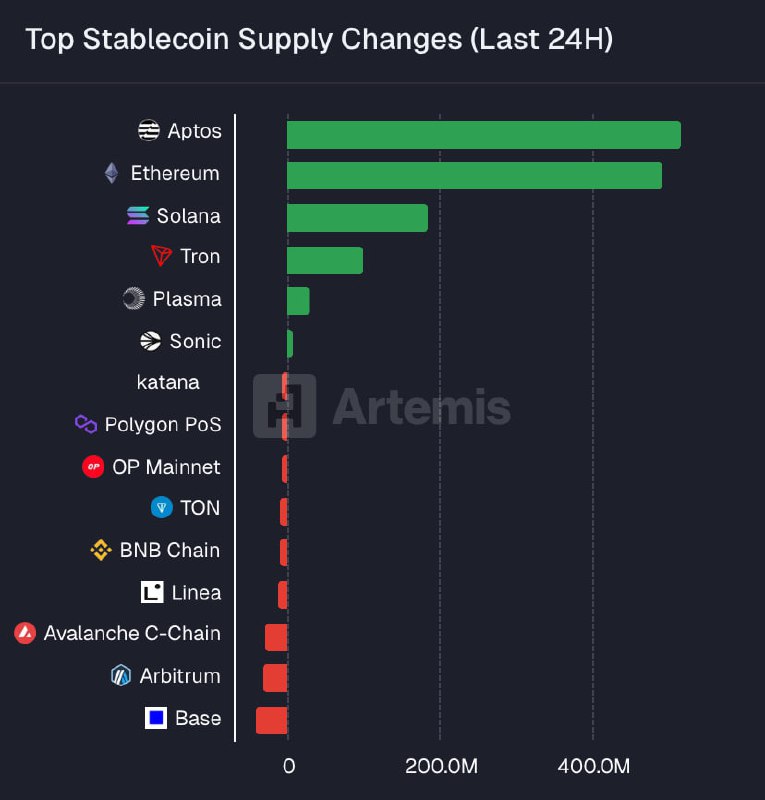

Aptos has topped the leaderboard for 24-hour stablecoin supply growth, edging past Ethereum and Solana, according to analytics data. The snapshot highlights shifting liquidity flows across major blockchains, with several networks posting net outflows.

Key Developments

Data visualized by the analytics platform Artemis shows the latest changes in stablecoin supply across leading blockchain ecosystems over the last 24 hours. The chart, titled "Top Stablecoin Supply Changes (Last 24H)," places Aptos at the top, reflecting the largest net increase in circulating stablecoins among tracked chains.

Networks with net increases:

- Aptos (largest increase)

- Ethereum

- Solana

Networks with net decreases:

- BNB Chain

- Linea

- Avalanche C-Chain

- Arbitrum

- Base

While the chart does not specify exact figures, the ranking indicates a marked uptick in stablecoin supply on Aptos relative to established leaders, with Ethereum and Solana also registering positive flows.

Market Context

Stablecoin supply changes are widely used as a proxy for liquidity movement and on-chain activity:

- An increase in stablecoin supply on a chain can signal rising liquidity, potential demand for trading, lending, and DeFi participation.

- A decrease may indicate capital rotation to other networks, reduced risk appetite, or withdrawals to centralized venues.

The latest readings suggest a short-term rotation benefiting Aptos, while some prominent EVM ecosystems, including BNB Chain and Arbitrum, experienced outflows during the same window.

Why It Matters

- Liquidity signal: Tracking stablecoin supply offers a real-time gauge of capital flows between ecosystems.

- Competitive dynamics: Aptos outpacing Ethereum in this 24-hour period underscores competitive momentum among L1 and L2 networks to attract users and capital.

- DeFi implications: Shifts in stablecoin liquidity can influence yields, trading volumes, and protocol activity across chains.

Looking Ahead

If sustained, Aptos’ recent momentum in stablecoin inflows could translate into higher on-chain activity and DeFi engagement. Market participants will monitor whether this is a transient spike or part of a broader rotation across layer-1 and layer-2 ecosystems.