Lead

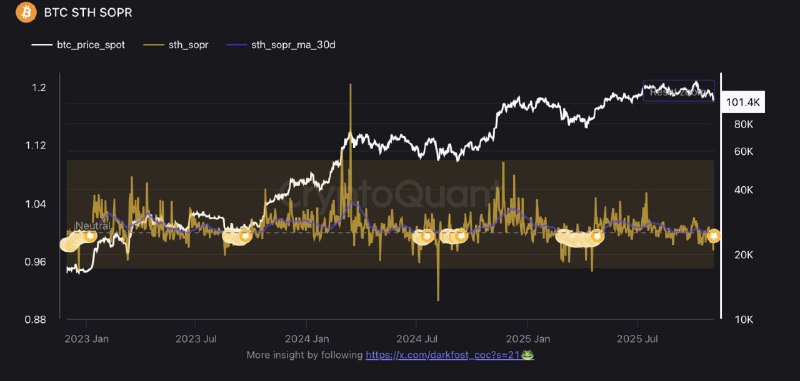

An on-chain analyst highlighted the Short-Term Holder (STH) SOPR threshold of 0.995 as a key Bitcoin market signal. When the metric drops below this level, it indicates short-term holders are selling at a loss—often coinciding with capitulation and potential entry opportunities. Recent charts show Bitcoin around $101,400, with STH SOPR hovering near 1.00 and a 30-day moving average smoothing fluctuations.

Key Developments

- Threshold to watch: An STH SOPR reading below 0.995 signals that short-term holders are realizing losses.

- Capitulation context: Such dips can mark periods of short-term capitulation, historically associated with improved risk–reward for buyers during uptrends.

- Current backdrop: A recent chart depicts BTC price near $101.4K, a rising trend into late 2024/2025, and STH SOPR oscillating around 1.00 with a 30-day moving average overlay.

"When the ratio falls below 0.995, it signals that short-term holders are selling at a loss. When STH begin to capitulate, good opportunities can arise," an analyst noted.

What Is STH SOPR?

- SOPR (Spent Output Profit Ratio) measures whether moved coins were sold in profit (>1) or at a loss (<1).

- STH SOPR focuses on coins held for a short period (commonly less than ~155 days), offering a lens into fast-moving market participants.

- Readings near 1.00 indicate breakeven behavior, while persistent dips below 1.00 suggest loss-taking pressure from short-term holders.

Why It Matters

- In advancing markets, brief STH SOPR dips below 1.00 (or the 0.995 threshold) can reflect shakeouts where weaker hands exit, sometimes preceding rebounds.

- Conversely, sustained readings above 1.00 indicate broad profit realization, which can contribute to resistance if sellers dominate.

Market Context

- The referenced chart shows:

- BTC price: Approximately $101.4K at the far right, with an upward trajectory from 2023 through 2024.

- STH SOPR: Fluctuating around 1.00, with a 30-day moving average to smooth noise.

- Annotations highlighting phases of “Net Realized Profit”, aligning with periods when SOPR runs above 1.

Looking Ahead

Traders are monitoring STH SOPR for a decisive move. A drop below 0.995 could signal short-term capitulation and potential opportunity if broader market structure remains constructive. Conversely, a sustained push above 1.00 would indicate profit-taking pressure that could challenge further upside.