Key Takeaway

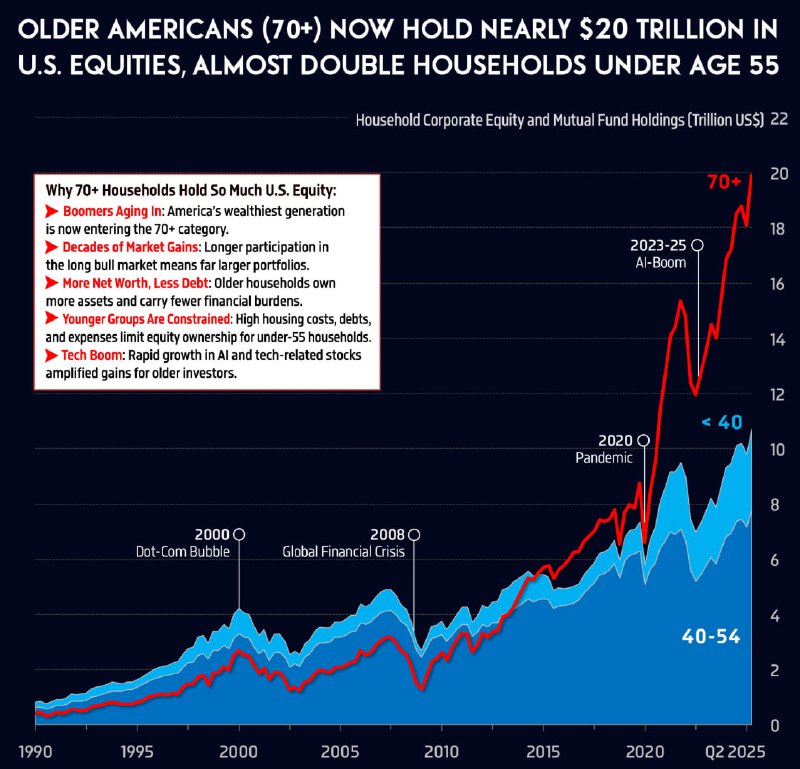

Older Americans are now the dominant holders of U.S. equities. Households aged 70 and above hold nearly $20 trillion in U.S. stocks—almost twice as much as households younger than 55, based on the latest readings through Q2 2025. The trend has accelerated since around 2010, reflecting demographic shifts and a prolonged bull market.

Key Developments

- Households 70+ collectively hold close to $20 trillion in U.S. equities.

- This total is nearly double the equity holdings of households under 55.

- The data span from 1990 to Q2 2025, showing a steady climb in senior holdings with a marked acceleration post-2010.

- Major market events such as the Dot-Com Bubble, the Global Financial Crisis, and the COVID-19 pandemic align with visible shifts in equity holdings over time.

Context and Drivers

Equity ownership has increasingly concentrated among older Americans over the past decade and a half. Several structural forces likely underpin the shift:

- Longer lifespans and delayed retirement, extending the investment horizon for older cohorts.

- A multi-year bull market that inflated equity values and retirement portfolios.

- The compounding effect of long-term investing in tax-advantaged accounts.

- Demographic trends, including the large Baby Boomer cohort transitioning into the 70+ bracket.

Market Impact

The growing concentration of equity wealth among retirees and near-retirees can influence market dynamics:

- Potential for more conservative portfolio positioning (income and blue-chip focus).

- Sensitivity to interest rates and dividend policies.

- Over the medium term, retirement withdrawals could gradually alter equity demand.

Implications for Crypto and Digital Assets

- Near-term, wealth concentration among older investors may favor traditional assets, potentially moderating retail-driven risk appetite in digital assets.

- Over the long term, intergenerational wealth transfer could increase the share of assets controlled by younger cohorts, historically more open to crypto adoption and digital-native investments.

Looking Ahead

Investors should watch allocation patterns among older households, withdrawal trends, and demographic shifts. These factors will shape liquidity, sector leadership, and risk appetite across both equities and digital assets as the market digests the implications of aging wealth.