Lead

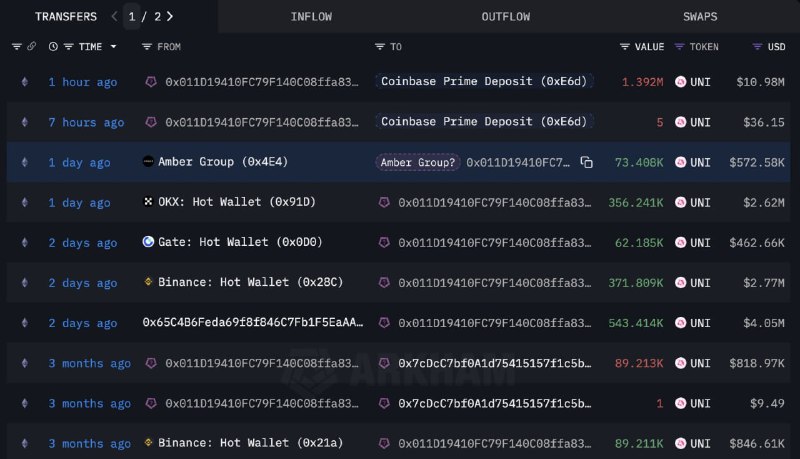

A wallet associated with Amber Group accumulated approximately 1.41 million UNI (about $11 million) over the past three days and deposited 1.39 million UNI (around $10.98 million) to Coinbase Prime roughly an hour ago, likely for custody. On-chain records also show additional large token movements involving UNI and AAVE.

Key Developments

- A wallet linked to Amber Group accumulated about 1.41M UNI (~$11M) in the last three days.

- Approximately 1.39M UNI (~$10.98M) was deposited to Coinbase Prime about an hour ago, labeled as a Coinbase Prime deposit and likely for institutional custody.

- Other notable recent transfers observed from the wallet include:

- 356.24K UNI (~$2.62M)

- 677.3K UNI (~$4.99M)

- 73.48K AAVE (~$572.5K)

Context

Amber Group is a major digital asset firm active in market making and institutional trading. Coinbase Prime is Coinbase’s institutional platform providing custody and execution services. Large, labeled inflows to Coinbase Prime often indicate custodial allocation or inventory management by professional trading desks rather than immediate sell pressure.

Market Impact

While no immediate price reaction is cited, the scale and cadence of these transfers underscore continued institutional engagement with DeFi tokens, particularly Uniswap’s UNI. Such movements can influence liquidity, order book depth, and exchange reserves, and they are closely watched by traders for potential shifts in market positioning.

Looking Ahead

Observers will monitor:

- Further inflows or outflows from the wallet to exchanges.

- Any subsequent activity involving UNI or related DeFi tokens.

- Changes in exchange balances that could signal near-term liquidity or trading intent.

The latest activity suggests active treasury or custody management around UNI, reinforcing the role of institutional platforms in handling large-cap DeFi assets.