Lead

Artificial intelligence data centers are poised to draw heavily on capital markets, with new estimates indicating a need for approximately $1.5 trillion in investment‑grade bond financing over the next five years. Additional funding is expected to come from equity, structured products, leveraged finance, and organic cash flows to bridge a sizable capital gap.

Key Developments

AI data centers will require around $1.5 trillion in investment‑grade bonds over the next five years.

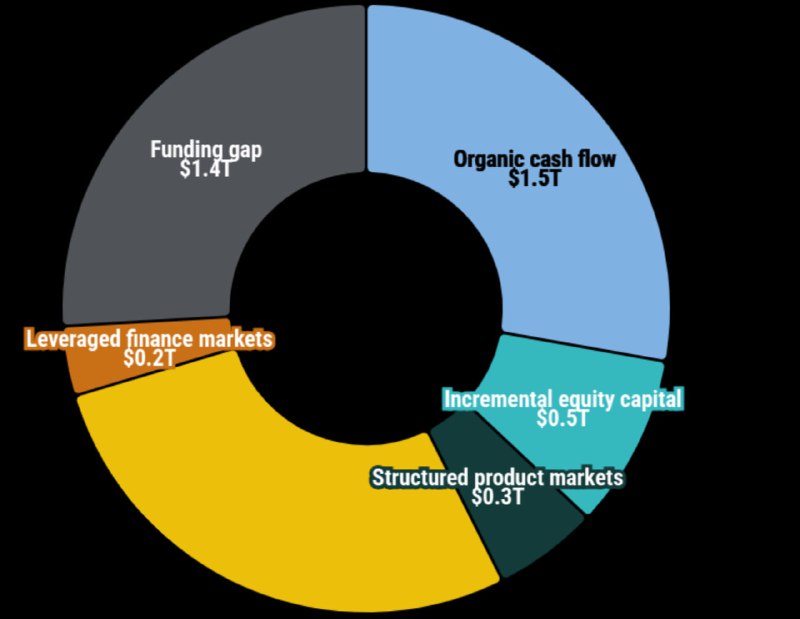

Based on the latest projections and financing breakdowns:

- Organic cash flow: approximately $1.5 trillion

- Funding gap: approximately $1.4 trillion

- Incremental equity capital: approximately $0.5 trillion

- Structured product markets: approximately $0.3 trillion

- Leveraged finance markets: approximately $0.2 trillion

These figures suggest a multi‑layered capital stack for AI infrastructure build‑outs, with investment‑grade bonds expected to shoulder a leading share, complemented by equity issuance and structured/leveraged financing. The projected funding gap underscores the magnitude of required external financing relative to internally generated cash flows.

Context and Drivers

AI data centers demand substantial upfront capital for:

- High‑performance compute (HPC) hardware and networking

- Large‑scale power procurement and grid interconnection

- Advanced cooling systems and real estate build‑outs

The scale and duration of these investments make long‑dated, lower‑cost financing—such as investment‑grade bonds—particularly attractive for operators and hyperscalers seeking to optimize their weighted average cost of capital.

Market Impact

- Credit markets: A potential $1.5T issuance pipeline could influence investment‑grade spreads and sector allocation across utilities, technology, and digital infrastructure.

- Structured finance: An estimated $0.3T via structured products hints at growing securitization opportunities tied to data center assets and long‑term offtake contracts.

- Equity and leveraged finance: With around $0.5T in incremental equity and $0.2T in leveraged finance, sponsors may diversify capital sources to manage risk and leverage profiles.

Why It Matters for Crypto and Digital Assets

- Infrastructure overlap: The expansion of power‑intensive AI facilities parallels the energy and data needs of blockchain validators and Bitcoin miners, potentially affecting power pricing and site competition.

- Capital flows: Large‑scale bond and equity issuance for AI infrastructure can shape broader risk appetite and liquidity conditions, indirectly influencing digital asset market sentiment.

- Compute markets: Increased AI demand for chips and data center capacity may tighten supply chains relevant to decentralized compute and edge‑network projects.

Looking Ahead

The financing mix for AI data centers will likely evolve with interest rate conditions, regulatory developments in power markets, and hardware supply cycles. Investors will watch how operators balance investment‑grade issuance with equity and structured solutions to close the projected funding gap while scaling capacity efficiently.