Lead

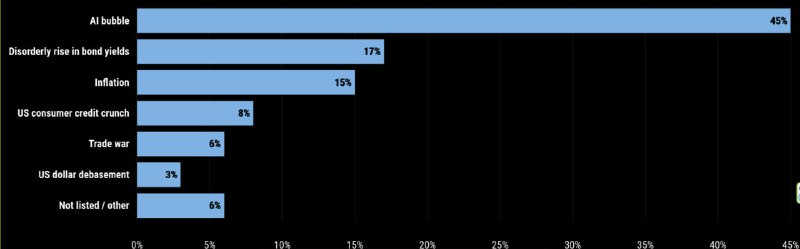

A recent Fund Manager Survey (FMS) shows that 45% of investors view an AI bubble as the biggest side risk for global markets, a sharp increase of 12 percentage points from the previous month. Traditional macro concerns like bond yields and inflation trail well behind in the ranking.

Key Developments

The survey highlights a clear shift in perceived market risks:

- AI bubble: 45% (up 12 points month-over-month)

- Disorderly rise in bond yields: 17%

- Inflation: 15%

- US consumer credit crunch: 8%

- Trade war: 6%

- US dollar debasement: 3%

- Not listed/other: 6%

The data indicates that concerns around stretched valuations in artificial intelligence-related equities are now the dominant worry among institutional investors, outpacing fears tied to rates, prices, and geopolitical trade risks.

Market Context

The surge in AI bubble risk perception reflects accelerated capital flows into AI-linked stocks and infrastructure plays, raising questions about sustainability of earnings and valuations. Meanwhile, the 17% citing a disorderly rise in bond yields and 15% naming inflation suggest investors remain vigilant about macro tightening and price pressures, though these are now secondary to AI-driven exuberance.

The relatively low 3% citing US dollar debasement implies diminished concern over currency erosion compared to other macro risks. US consumer credit strains (8%) and trade war risks (6%) are viewed as notable but not dominant threats in the current cycle.

Implications for Crypto Markets

- If AI-related equities stumble, a broader risk-off move could pressure speculative assets, including Bitcoin and altcoins.

- Elevated sensitivity to bond yields and inflation means crypto may remain reactive to macro data and rate expectations.

- The minimal focus on USD debasement in this survey could signal that monetary debasement narratives are not top-of-mind for institutional allocators right now, potentially tempering immediate safe-haven or inflation-hedge flows into digital assets.

Looking Ahead

Investors are likely to watch AI-led equity performance, inflation prints, and bond market volatility as key signals for risk appetite. For crypto, near-term sentiment may hinge on whether AI valuations cool orderly or trigger wider de-risking across growth and speculative segments.

Conclusion

The FMS underscores a notable pivot: AI bubble fears now dominate market risk perceptions, eclipsing traditional macro concerns. For digital assets, the path forward may depend on how AI-driven market dynamics unfold alongside the macro backdrop of yields and inflation.